This 1833 Democratic cartoon shows Democrat Andrew Jackson destroying the Devil’s Bank. Times have changed. Wikipedia Illustration.

Even though I’ve always been a Republican, I always believed that most Democrats want to “stand up for the little guy.” Their policies actually hurt the little guy, but at least their heart is in the right place, and their motives are pure. Or so I used to believe.

Maybe that’s still true of some Democrats, but it’s becoming less and less common. I first realized this when I started to see how many ties there were between big business and the Democrats. At first, I dismissed this as “country club liberalism.” So the argument goes, the wealthy feel guilty about their ill-gotten lucre, and to atone for their sins, they support liberal causes. But then, I started to notice that it’s generally the biggest of the big that benefit from Democratic policies. If you’re a large bank or a large insurance company, or even a large polluter, you’re well capitalized, and you can bear the regulatory burdens as a cost of doing business, and then simply pass those costs on to your customers.

But if you’re a small bank, or a small insurance company, or even a small polluter, you don’t have sufficient capital to bear those regulatory burdens. As a result, you go out of business. Or, if you’re lucky, one of your well capitalized competitors buys you out. To your former competitors, the regulatory burdens are a non-issue. They simply pass those costs along to their customers. And now, as an added bonus, they don’t have to worry about competition.

This point was driven home to me when I recently happened to look at the Campaign Finance reports filed this year by my legislator, Rep. Alice Hausman. I happened to be looking at those reports because of an address mix-up, as I previously reported on this blog.

According to Rep. Hausman’s campaign website, the legislator believes in “investing in hard-working families and middle-class Minnesotans.” She believes in a livable wage, affordable housing, and, ironically enough, relieving the burden of debt on college students. Her legislative website contains a press release about fighting financial scams.

In short, she has concern for the little person, she recognizes the burden of debt, and she’s worried about financial scams. But one incongruous name kept showing up on her campaign finance reports, that of law firm Messerli & Kramer. In 2014, she received a contribution of $250 from Messerli & Kramer lobbyist John Apitz. During 2013, Apitz had also contributed another $250, and Messerli & Kramer lobbyist Ross E. Kramer contributed $250. In addition, the Messerli & Kramer Political Action Committee had donated $250 to her campaign coffers. So in just over 18 months, the law firm was responsible for a thousand dollars in the legislator’s war chest.

A lot of little people probably recognize the name Messerli & Kramer. They’re very likely to recognize that name if they are worried about financial scams or the burden of debt, because Messerli & Kramer is one of the state’s largest debt collectors. And they’ve been called on the carpet many times for their practices in collecting those debts.

Like any other business, Messerli & Kramer has a right to give money to politicians. The Citizens United case makes clear that they have that right. But the name stands out like a sore thumb in support of someone who supposedly supports the little guy.

Messerli & Kramer is a prestigious law firm with offices in Minneapolis, St. Paul, and Milwaukee. Most little people don’t know the names of prestigious law firms, but anyone in Minnesota who has gotten behind on a car payment or a credit card bill probably knows the name Messerli & Kramer, since the firm’s Plymouth office operates a high-volume debt collection practice. In fact, because the firm does such a high volume of business, it has resorted to outsourcing to a company in Birmingham, Alabama, simply to mail out the huge volume of correspondence. They send out so many collection letters that their own office can’t handle the volume.

My personal involvement with Messerli & Kramer dates back to 2002 when I was hired by a woman who needed to sort out a mess involving her Discover Credit Card. She was being sued in Anoka County, and Discover was represented by that friend of the little guy, Messerli & Kramer. I was appalled by the tactics employed by Messerli & Kramer. Messerli and Kramer attorneys made false statements in an affidavit in order to obtain a default judgment. I had to go to court and get the default judgment set aside. Then, Messerli & Kramer failed to properly respond to discovery. The judge in the case, District Judge Sharon Hall, found that the plaintiff offered an affidavit containing false statements, failed to comply with court rules, and failed to cooperate in the discovery process.

Judge Hall set aside the default judgment, and held that the firm’s misconduct was so egregious as to warrant simply tossing out the plaintiff’s case. She also awarded my attorney fees.

Dissatisfied with this turn of events, Messerli & Kramer took the case to the Minnesota Court of Appeals. In 2004, the Court of Appeals affirmed, and awarded my attorney fees on appeal.

In 2007, the Minnesota Attorney General filed a lawsuit against Messerli and Kramer. The state’s 38-page complaint referred to my earlier case, as well as numerous other cases of misconduct by the law firm in its collection activities. That complaint noted that Messerli & Kramer is involved in the collection of student loan debt, the very burden that Rep. Hausman’s website professes concern.

Banks, credit card companies, and student loan lenders are entitled to legal representation. But Messerli & Kramer has a documented history of abuses in carrying out those representations.

Many middle-class Minnesotans instantly recognize the name of Messerli & Kramer. And if they live in Roseville, Falcon Heights, Lauderdale, and St. Paul, they’re probably represented in the legislature by Rep. Alice Hausman. Can they turn to their legislator for support when abuses occur? Can they turn to the legislator who accepted a thousand dollars in campaign contributions from the very firm that is hounding them?

Unfortunately, voters in other districts encounter the same problem, and it doesn’t matter whether your representative is a Republican or a Democrat. The Messerli and Kramer cash flows freely, and they’re happy to give money to Republicans as well as Democrats. Messerli and Kramer’s political contributions can be found at FollowTheMoney.org, That site reveals that over the last 18 years, they gave over a quarter of a million dollars to politicians, with little regard for the politician’s views. Democrats seem to have received a slim majority of their cash, but Republicans are well represented as well. In 2002, they gave to Republican Tim Pawlenty. In 2014, they once again had the checkbook out, this time giving to Democrat incumbent Mark Dayton.

Not too surprisingly, back in 2002 (about the same time they were filing false affidavits in Anoka County), they also donated to Democrat Roger Moe, who was running against Pawlenty. That same year, they donated to Rep. Rich Stanek, a Republican, who currently serves as the Hennepin County Sheriff, the guy who needs to execute the writs against the people that Messerli and Kramer is suing.

In 2006, they gave to ultra-conservative Republican Jim Abeler. But political ideology didn’t stop them from giving. The same year, they also donated to ultra-liberal Democrat Ellen Anderson.

Nobody has done anything illegal. The Citizens United case gives them the right to give money to Representative Hausman, or to another politician with opposing views. It even gives them the right to donate to both sides, which appears to be exactly what they are doing. But the voters ought to know about it and decide in the polling place whether this is just plain wrong.

This post expresses the opinions of the author, Richard P. Clem, who prepared and paid for it. This post is not authorized by any candidate or candidate’s committee.

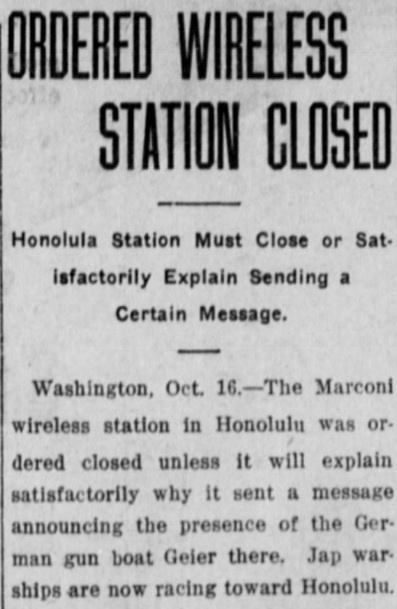

In the early days of the Great War, the U.S. Government was struggling with how to deal with wireless stations in relation to U.S. neutrality. We’ve seen other examples of how they were dealing with communications in the Atlantic.

In the early days of the Great War, the U.S. Government was struggling with how to deal with wireless stations in relation to U.S. neutrality. We’ve seen other examples of how they were dealing with communications in the Atlantic.