Joining the Ranks of the Uninsured

My wife was recently informed that as of January 1, she will no longer have health coverage through work. Ironically enough, she works for a hospital. We were instead encouraged to go to the MnSure website (Minnesota’s brand of Obamacare) to purchase coverage there.

What Obamacare Has To Offer

The least expensive policy there has a $589.40 monthly premium for a UCare plan with a $10,000 deductible and $13,200 maximum out of pocket. While a handful of preventitive services would be covered at no cost, with the $10,000 deductible, it’s unlikely that we would ever make a claim. In other words, in addition to paying over $7000 per year in insurance premiums, we would still have to pay whatever medical bills we incurred throughout the year (unless, of course, we were “lucky” enough to have more than $10,000 in medical bills). In short, this is no different from a traditional major medical policy, other than the premiums being an order of magnitude higher.

The least expensive policy there has a $589.40 monthly premium for a UCare plan with a $10,000 deductible and $13,200 maximum out of pocket. While a handful of preventitive services would be covered at no cost, with the $10,000 deductible, it’s unlikely that we would ever make a claim. In other words, in addition to paying over $7000 per year in insurance premiums, we would still have to pay whatever medical bills we incurred throughout the year (unless, of course, we were “lucky” enough to have more than $10,000 in medical bills). In short, this is no different from a traditional major medical policy, other than the premiums being an order of magnitude higher.

The plan with the lowest deductible of $0, but with a maximum out of pocket of $12,000, from BlueCross BlueShield, had a monthly premium of $1183.81. Presumably, by paying over $14,000 in premiums in the course of a year, most bills would be covered, but there’s still the possibility of having to pay an additional $12,000 out of pocket.

Neither option is “affordable.” Therefore, as of January 1, my family will no longer have health insurance coverage. As a direct result of the so-called Affordable Care Act, my family can’t afford health insurance.

Exploring the Exemptions: Becoming a Hardship Case

Fortunately, there’s a silver lining, since this allowed us to explore other options. There are exemptions to the Affordable Care Act. For example, you’re not liable for the penalty if you can come up with a disconnection notice from a utility company. This could be arranged with little difficulty, although it’s problematic for a couple of reasons. First of all, the exemption appears to be available only for the “month of the hardship” as well as the months before and after. So to take full advantage of this loophole, I would need to pay the electric bill in such a way as to receive a total of four disconnection notices over the course of a year. This would entail a lot of careful planning, as well as hoping that the friendly electric utility would send the required disconnection notice on time. If I accidentally paid the electric bill on time, we would be liable to the penalty for not having insurance. And it seems unfair to the electric company to make them do this additional work in order to satisfy the requirements of the health insurance industry.

Fortunately, there’s a silver lining, since this allowed us to explore other options. There are exemptions to the Affordable Care Act. For example, you’re not liable for the penalty if you can come up with a disconnection notice from a utility company. This could be arranged with little difficulty, although it’s problematic for a couple of reasons. First of all, the exemption appears to be available only for the “month of the hardship” as well as the months before and after. So to take full advantage of this loophole, I would need to pay the electric bill in such a way as to receive a total of four disconnection notices over the course of a year. This would entail a lot of careful planning, as well as hoping that the friendly electric utility would send the required disconnection notice on time. If I accidentally paid the electric bill on time, we would be liable to the penalty for not having insurance. And it seems unfair to the electric company to make them do this additional work in order to satisfy the requirements of the health insurance industry.

But most importantly, even though we might avoid the fine, we would still be without health coverage. So taking advantage of the hardship exemption doesn’t seem like a very good plan.

A Better Alternative: A Health Sharing Ministry

A more prudent exemption is for “a member of a recognized health care sharing ministry.” More background information about this option can be found at the following links:

A more prudent exemption is for “a member of a recognized health care sharing ministry.” More background information about this option can be found at the following links:

Under the Affordable Care Act, for this exemption to apply, the organization must have been in existence since at least December 31, 1999, and the members must share common ethical or religious beliefs. Because of this requirement, it’s apparently impossible for a new health care sharing ministry to be formed. All of the existing ones appear to be Christian organizations.

Why This is Unfair to Other Faiths

Frankly, this is unfair to members of other faiths. It seems to me that persons of faiths other than Christianity ought to be able to participate in such an organization. Unfortunately, none exist. The remedy, it seems to me, is to eliminate the December 31, 1999, requirement, so that members of other faiths can form such organizations if they desire to do so. For that reason, I would strongly support a change in the law to remove this requirement. But as far as I know, the only ministries that were established as of the magic date of December 31, 1999, were Christian. Fortunately, we happen to be Christian, and were thus eligible to join any of the existing ministries.

Frankly, this is unfair to members of other faiths. It seems to me that persons of faiths other than Christianity ought to be able to participate in such an organization. Unfortunately, none exist. The remedy, it seems to me, is to eliminate the December 31, 1999, requirement, so that members of other faiths can form such organizations if they desire to do so. For that reason, I would strongly support a change in the law to remove this requirement. But as far as I know, the only ministries that were established as of the magic date of December 31, 1999, were Christian. Fortunately, we happen to be Christian, and were thus eligible to join any of the existing ministries.

The Three Eligible Ministries and How They Work

The only three eligible organizations appear to be:

Each of these organizations has a statement of faith expressed in general enough terms that a member of any Christian denomination should be able to subscribe in good conscience.

All of these organizations operate under the same general principles. First, they all go to great lengths to stress the fact that they do not offer insurance. And, indeed, they do not. Instead, they operate on the principle under which insurance was originally based: The members agree to assist the other members in time of need, both spiritually and materially. If someone gets sick, the other members are asked to pray for that person. And the other members are also asked to help them pay their medical bills.

Premiums are not collected up front, as in the case of insurance. Instead, when someone has a medical need, they submit it to the other members. And then the other members contribute money to meet that need, in addition to offering prayers and encouragement. As far as I can tell, the other members have no legal obligation to help with the need. Instead, the members of the ministry simply rely upon the other members, knowing that those other members will turn to them in their own time of need.

How Samaritan Works

After studying these organizations, we decided to join Samaritan Ministries, and our membership takes effect on January 1, the day after our insurance ends. The different organizations work somewhat differently, but here is how Samaritan Ministries works:

After studying these organizations, we decided to join Samaritan Ministries, and our membership takes effect on January 1, the day after our insurance ends. The different organizations work somewhat differently, but here is how Samaritan Ministries works:

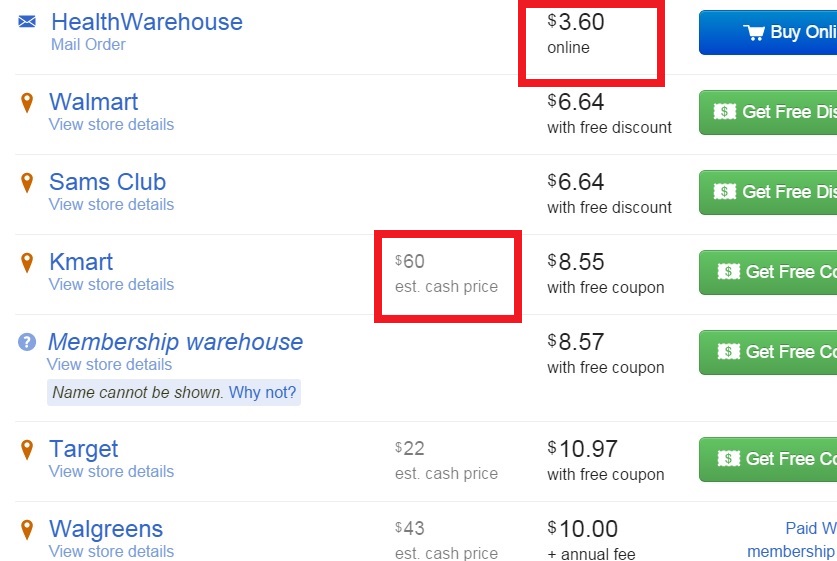

If you’re sick, you simply go to the doctor and explain that you’ll be paying yourself, and you make payment arrangements, whether that is cash at the time of service, charging it to a credit card, or making payment arrangements. Because no insurance company will be involved in the process, it is up to the patient to shop around for a reasonable price. (Assistance in that regard is offered, however, if needed.)

For small medical bills (basically, under $300 per incident) that’s the end of it. In other words, if I have a cold and decide to go to the doctor, I’ll make an appointment at the doctor of my choice, see him or her, and pay the bill. Perhaps I’ll pay $50 for the visit. If I’m quoted a price that’s too high, then I’ll go elsewhere.

In other words, it’s similar to what would happen if I had the $589.40 per month plan. I go to the doctor and pay the full bill. The only difference is that if I have the $589.40 per month plan, I probably don’t have any opportunity to negotiate. Perhaps UCare negotiated a better deal, and I would only have to pay $40 if I showed my UCare card. If that’s the case, then I’m out $10 for not forking over my $589.40.

On the other hand, perhaps UCare didn’t negotiate a better price. Perhaps they negotiated a price of $60 for the visit. If that’s the case, then my $589.40 per month premium actually results in my paying $10 more at the time of service. Either way, for small medical needs, I’m not getting much if any value from my $589.40 premium.

Of course, I would be better off if I had signed up for the $1183.81 per month plan from BlueCross. If I had that plan (assuming I showed up at the right clinic, of course), then I wouldn’t have to worry about paying $50 for my cold. But it seems to me that I’m probably not going to have enough colds in any given month to cover the $1183.81 premium. Even if I have one cold per month, I’m still out $1133.81.

If my bill for a particular episode is $300 or less, that’s how it works. I don’t submit any claims anywhere; I simply pay them. While paying $300 wouldn’t be pleasant, this will not bankrupt me. What would bankrupt me would be paying the $1183.81 in an effort to avoid paying the $300.

If my bill hits $300, this is where Samaritan Ministries will help me. So instead of a cold, let’s assume that I have a heart attack. I assume that the going price for treating a heart is more than $300.

Once again, I tell the doctor that I’m a self-pay customer and that he or she should send me a bill. (Or, more likely, the people who rush me to the hospital share this information.) When I get home, I receive the bill for $100,000, an amount that would bankrupt me. Since I’m busy recuperating from my heart attack, I call Samaritan and ask them to help me deal with it. At that point, they do two things. First of all, they help me negotiate the bill down if appropriate. Then, they send my name and address to one or more other members, and ask those members to pray for me and send me $99,700 ($100,000, minus my $300 responsibility, minus anything they negotiated off the bill). The maximum amount paid by any given member is $405 per month. So in this hypothetical, I’ll receive more than 246 individual checks, payable to me, with a grand total of $99,700. As far as I can tell, the minor annoyance of having to deposit all of those individual checks is about the only downside of this approach. And it seems to me that this minor annoyance is offset by the knowledge that these 246 people are also praying for my speedy recovery.

More likely, any use we make of this service will be for more modest amounts. For example, if we have a medical bill of $1000, and Samaritan is able to negotiate it down to $800, then we will get $700 from fellow members and be responsible for $100 ourselves. Had we signed up for the $1183.81 per month plan, we would not have had to pay this $100 (assuming, of course, that we showed up at the right clinic). If we had signed up for the $589.40 per month plan, then we would have to pay the full $1000 out of pocket.

In short, given almost any plausible scenario, we’re way ahead of the game by using Samaritan. While we didn’t explore them as deeply, it appears that we would have similar savings with one of the other two ministries.

In return for this, we agree to pay up to $405 per month to other members. Once per year, this money is instead sent to Samaritan’s administrative office, meaning that they take 1/12 (about 8%) to cover administrative expenses. I suspect that this is far below the administrative expenses of any insurance company. Other months, we’ll be given the name and address of one or more other members, and will be instructed to send our $405 directly to them, along with our prayers and encouragement. For the last two months, medical needs have apparently been lower than expected, so for the last two months, members have actually sent less than the normal $405 per month. Apparently, the monthly amount used to be $355 but recently increased to $405. But in the last two months, there was, in effect, a discount on what members had to pay, and they did not pay the full $405.

This basic plan covers medical needs of up to $250,000. For amounts in excess of that, there is an option to participate in another program. Members are asked to set aside another amount (about $400 per year) and share that amount in case another member experiences a catastrophic need in excess of the basic $250,000. We opted to participate in that program as well.

How Much It Costs

The basic membership in our case, for a family of three or more, is a commitment of $405 per month. Most months, we will expect to send that amount to other members (although some months, such as the last two, the actual amount will be less). For a single person, the monthly share is $180. For a couple, it is $360. For a single parent and child(ren), it is $250. Rates are slightly lower for young adults under 25 years of age.

In addition to these fees, there is a $200 initial membership fee, and a $15 annual fee for participation in the over $250,000 plan.

If we’re lucky, we’ll spend $405 per month, and never be reimbursed for any of our own medical needs. But if we do have a medical need, what Samaritan offers seems vastly superior to anything that MNSure has to offer. I will periodically update as to our experiences with Samaritan Ministries. All of the reviews I’ve read from other members have been positive. Even though it is not insurance, what Samaritan Ministries offers is more like what insurance was originally intended to be, before people realized that they could make a profit by selling it.

Asking a Favor of You

Finally, if you do decide to sign up for Samaritan Ministries, I would appreciate if you would indicate on your application form that I referred you. There’s a box where you can check how you learned about Samaritan. If my information proved helpful, I would appreciate if you would include my name, Richard Clem. On the first page, you can check the box “Friend/referral (somebody told me)” and/or “Internet,” and write in my name. In the interest of full disclosure, if you do include my name as a referral, then I will receive a credit of $180.

And if one of the other ministries fits your needs better, then I encourage you to join them. The other two could very well work out better for some people. Do your homework and join the one that best meets your needs. But if Samaritan is the one for you, then I would appreciate if you would list me as having referred you.

Before making a decision, I encourage you to carefully read Samaritan’s website, and ask them any questions you might have. If you have any questions for me, feel free to ask. Since our membership doesn’t take effect until January 1, we don’t yet have any personal experience. But I will update this page with the good and the bad. But for now, I see very little bad, and this does seem to be a good option for those who are truly concerned with health care being affordable.

Click Here For Today’s Ripley’s Believe It Or Not Cartoon

![]()