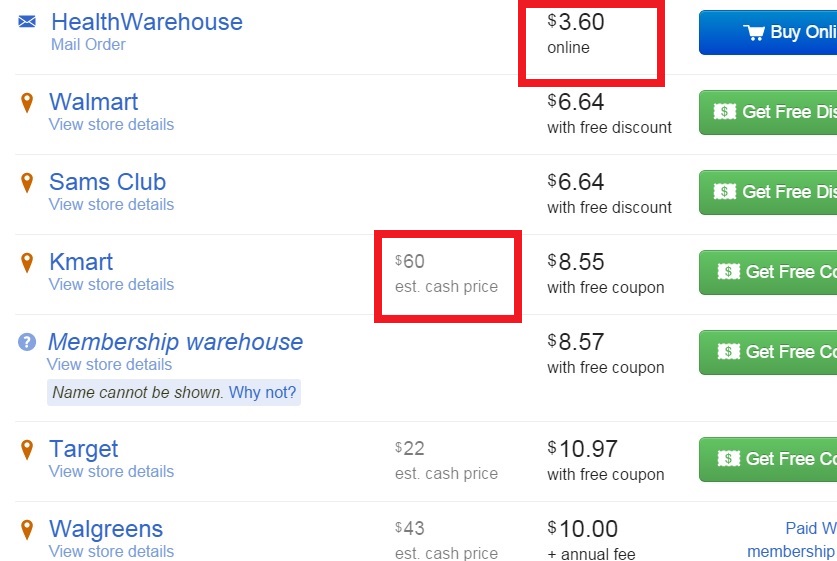

GoodRx.com Screenshot Showing Low and High Prices

Since January 1, my family no longer has health insurance. Instead of having traditional insurance, we decided to join Samaritan Ministries, a Christian health sharing ministry. I explained how Samaritan works in an earlier post. I’m periodically blogging about our experiences which, so far, have been overwhelmingly positive.

Now that we no longer have insurance, we have to do some things differently. One of the things we do differently is purchasing prescriptions. When we had insurance, we took the prescription to the friendly neighborhood pharmacist along with our health insurance card. The pharmacist scanned the card, gave us a little bag containing the pills, and we happily paid a flat rate of $20 or so to cover our “co-pay.” Sometimes, the co-pay would be less than $20, because our insurer worked out a better deal on our behalf.

Occasionally, we would ask the pharmacist how much the prescription would have cost if we didn’t have insurance. We were invariably quoted a much higher price, and we were thus reassured that our insurance was really paying off.

Now that we don’t have insurance, we have to do things differently. We can’t just walk into the store and expect to get out the door for $20. But it turns out that we now pay much less, now that we’re unburdened by insurance, as long as we don’t play the game in the form dictated by the insurance companies.

When we had our first prescription to fill after joining, we called Samaritan Ministries for guidance. Our friendly local pharmacist had quoted us a price of about $40 for a one month supply, and we were hoping we could reduce this a bit. Since we no longer had insurance, we assumed that we would have to pay more than our previous $20, but we hoped we could stay close to that figure. It turns out we were wrong–we actually wound up paying much less.

Samaritan sent us a list of websites which we could use to shop around. The first one on the list was GoodRx.com, which is actually a price comparison website. It confirmed the cash price we had been quoted. This particular prescription had a cash price of $41 at CVS or $43 at Walgreens. If a patient walked into KMart, the cash price would have been $60. Target, on the other hand, charges $22 for the exact same prescription. So far, the site confirmed what I had suspected: There would be savings if we shopped around, and we probably wouldn’t have to pay much more than the $20 we would have paid with insurance.

But this wasn’t the end of the story. We could get the exact same prescription at the same pharmacies for a much lower price simply by printing a coupon. The biggest savings would be at KMart. Simply by printing an online coupon, KMart would knock its price down a staggering amount, from $60 to $8.55. Other pharmacies had similar savings. By printing a coupon, Walmart would fill the prescription for only $6.64. At Target, the price would be $10.97 by printing the online coupon. In other words, normal price competition (calling pharmacies and asking for their cash prices) resulted in almost as low a price as we had with insurance. And by printing the online coupons, we were much better off than we were with insurance. If we had needed the prescription right away, we would have printed the Walmart coupon, and wound up paying $6.64–about a third of what we would have paid with insurance.

But even that isn’t the end of the story! We didn’t need the prescription immediately, and we were able to wait a few days. Therefore, we were able to take advantage of an even better deal: HealthWarehouse.com, a mail order pharmacy in Kentucky, had the exact same prescription for only $3.60, which included free shipping.

We placed the order online, and we were instructed to have the doctor fax the prescription to HealthWarehouse.com. The doctor did so, and the pills arrived a few days later. We ordered a 60 day supply, and the total price was $6.60. If we had insurance, this would have been about $40, and we would have been made to feel lucky about paying that amount, since the “normal” price would have been $86. And if we had been uninsured and didn’t bother shopping around, we would have just paid the $86. (And the hapless cash customer who walked into KMart would have paid $120!)

And if we really wanted to save even more money, we could also purchase this product from a Mexican pharmacy. The Mexican price for the same product appears to be about 25 pesos, which works out to $1.67. Since the price at HealthWarehouse.com is already so low, it’s probably not worth the added bother to save another $5. But in some cases, it might be worthwhile to take advantage of this option, which would reduce the price to practically nothing.

(We also checked Canadian pharmacies. In this particular case, we would have saved over the normal retail price by ordering online from Canada, but the HealthWarehouse.com price was considerably lower than the Canadian pharmacies we checked.)

The prevalence of the Health Insurance Industrial Complex has largely eliminated price competition. When we had insurance, we didn’t bother shopping for price, since we mistakenly assumed that our insurance company had already done that for us, by offering the “low” price of only $20 for a co-pay. Many people don’t realize how huge the price differences are. Even if you have health insurance, you will probably save money by not using your insurance card and instead shopping around as we did.

We paid $6.60, but we could have grudgingly paid $86 for the exact same prescription. And if we had insurance, we would have paid $40. The fact that we are now using Samaritan rather than traditional health insurance has made us smarter consumers.

If you want to learn more about Samaritan Ministries, please read my earlier post explaining how they work. As I explained in my other post, Samaritan does offer us a referral bonus. Therefore, if you decide to join, please include my name, Richard Clem, as the person who referred you.

Click Here For Today’s Ripley’s Believe It Or Not Cartoon

![]()

I also used GoodRX once, and saved a lot of money. Cash price fell from $300 to $112. Still a lot of money but more than 1/2 off.

Pingback: Blink Health Rx Review | OneTubeRadio.com